The Section 179 tax deduction provides tax relief for small businesses. It gives tax incentives to companies making qualifying purchases, encouraging them to invest in themselves through equipment cost deductions. Although initially developed to help small businesses, larger businesses also benefit from Section 179 in 2019.

Section 179 Benefits Explained

Businesses deduct the FULL price of a qualifying purchase in the year it is purchased, rather than depreciated over several years. Businesses can write off 100% of purchased or leased equipment, up to $1,000,000, with a cap of $2,500,000 for the total equipment purchased. Bonus depreciation changes from year to year, and is currently 100% in 2019.

Read more about the deduction here.

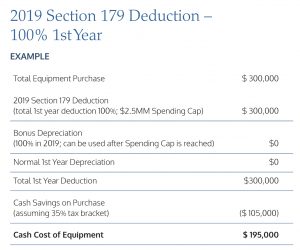

Here is an example of a KLC customer taking advantage of the deduction:

Look at the savings from using the Section 179 deduction! The total purchase price of equipment was $300,000, but our customer paid $195,000 after tax savings.

How to Get the Section 179 Benefits

To become eligible for Section 179, simply make a qualifying purchase before December 31, 2019. Almost all business equipment is eligible, both new and used, purchased or leased. These qualifying purchases include:

New and Used Equipment

- Heavy Machines

- Office Furniture

- Computers

Some Business-Use Vehicles

- Over-the-road Tractor Trailers

- Heavy Construction Equipment

- Forklifts

- Hotel/Airport Shuttle Vans

- Classic Cargo Vans

Off-the-shelf Software

Section 179 + KLC Financing

Maximize the benefits of Section 179 by using KLC to help you with your equipment financing! We pride ourselves on finding specialized solutions for our customers. Get in touch with KLC today and make 2020 a success!

Disclaimer: KLC Financial, Inc. and its owners are not tax advisers, and this page is not intended to offer tax advice. Please consult with a qualified professional concerning your specific situation.